We use cookies to give you the best digital experience. By continuing to browse this site, you give consent for cookies to be used. To learn more information about the use of cookies, please visit our cookie policy.

Tap into the high-net-worth opportunity in China

Focusing resources on the right people and right places is a defining success factor in marketing. For brands seeking to expand their high-net-worth (HNW) markets, reaching and impressing China’s high-net-worth individuals (HNWI) should be an ace card. Just a quick look at some numbers and you’ll see the Chinese HNWI market is lucrative and vast.

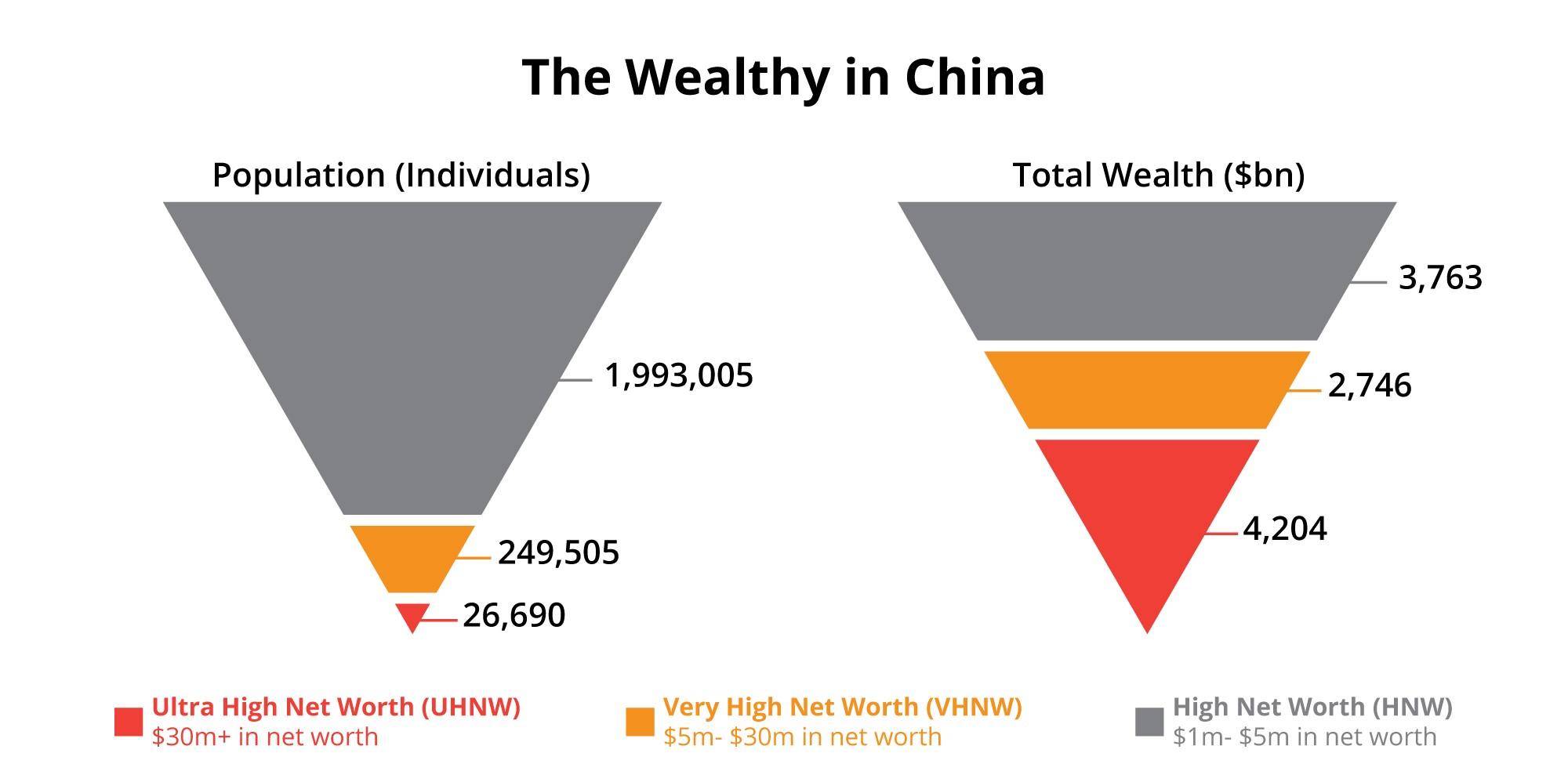

In China, the high-net-worth population—individuals with a net worth of US$1 million to less than US$30 million—has been growing rapidly. In 2018, China took the second place in the world in the number of millionaires (in USD, unless otherwise stated). A year later, in 2019, the number of adults in China with a net worth of US$100,000 to US$1 million stood at almost 109 million, and the country had a millionaire population of 4.47 million, equivalent to 3-digit growth in less than 5 years. China witnessed a 3-digit growth in its millionaire population in less than 5 years in the past decade. As for ultra-high-net-worth Chinese (i.e. individuals with assets of US$30 million or more), the number is projected to increase 35% in the next few years.

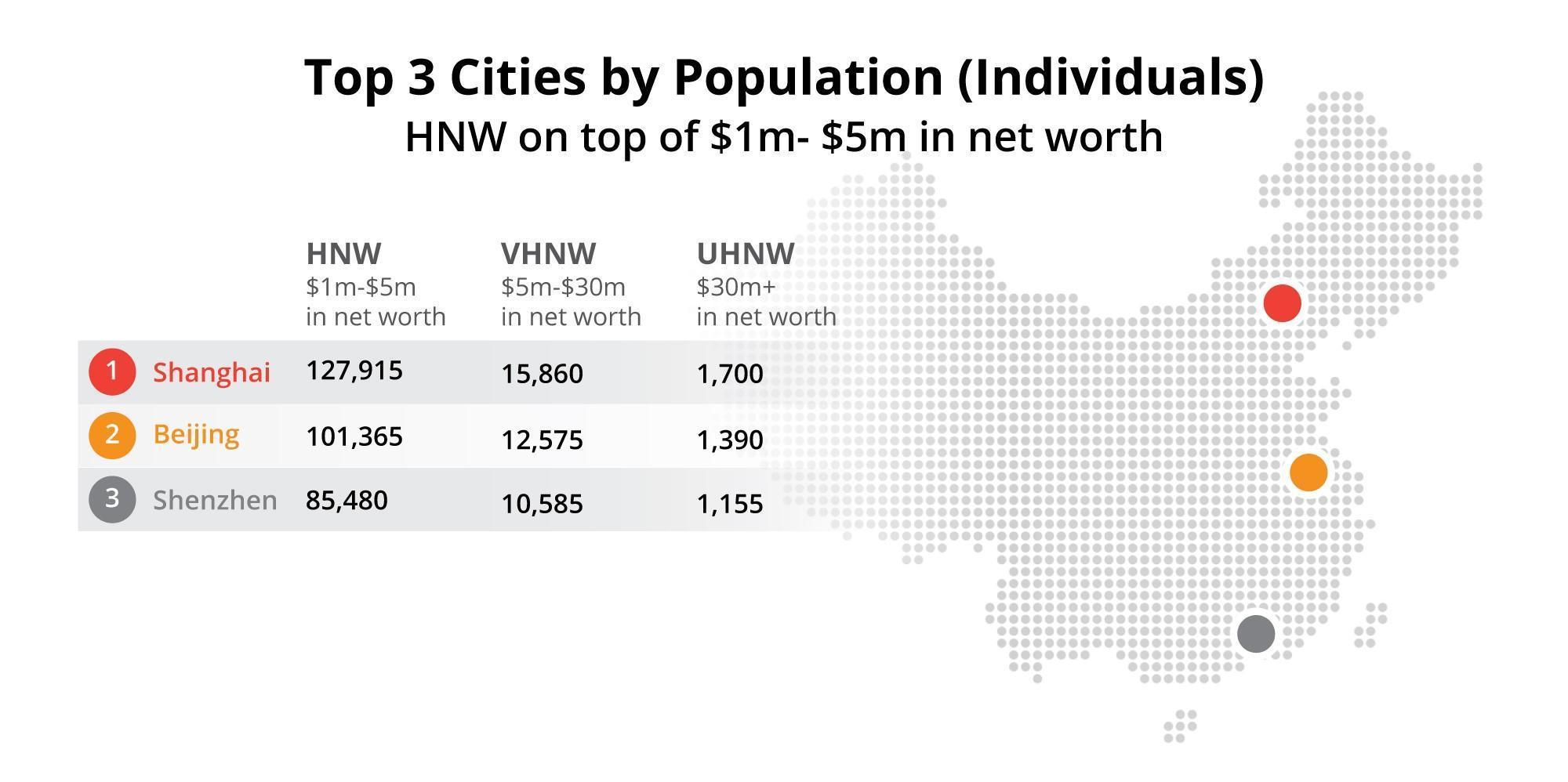

Within the country, Shanghai, Beijing and Shenzhen have the highest concentrations of wealthy Chinese. Also unparalleled globally is the country’s urbanization pace. It boasts more than 100 cities of over one million inhabitants and is home to 15 of the world’s 47 megacities.

That said, foreign brands and businesses not familiar with the rules of the game there will need success-proven intelligence and strategy to make the most of it. Having up-to-date information of the whereabouts, motivations, purchasing behavior, priorities and preferences of Chinese HNWI when it comes to high-end consumption is the prerequisite of marketing success. Marketing dollars should be spent with precision to get ahead of others.

China-specific digital strategy is essential

Digital marketing is incompatible with HNWI or luxury? Think again.

Citing a report by PwC, HNWI are enthusiastically adopting technology. They use multiple digital devices and spend 5 or more hours a day online. Moreover, a Bain research reveals the Chinese HNW population is diversified, including both entrepreneurs who opened factories decades ago, as well as younger professionals in the technology sector and other emerging industries. A one-of-a-kind scene in China, over a quarter of the ultra-rich is under the age of 50, versus a global average of 13%. Such a considerably lower average age implies higher tech savviness.

While the wealthy are using technology like everyone else, they have different needs, expectations and concerns than the mass market audience. For example, they may have more reservations when providing personal data online. They may also have a keener appetite for expertise and personalization.

Meanwhile, major platforms such as Google, Twitter, Facebook and YouTube are not accessible in China. Foreign advertisers need to employ tailored, highly segmented digital strategies that serve the unique Chinese market.

HNWI’ Internet use behavior and relevant strategies

Given that HNWI are well resourced, they are highly digitally informed and are selective about what contents and channels they spend time on. 85% of them use more than 3 digital devices. 89% use news websites and 60% use social media to get news. They also have high criteria when choosing what to read, stressing relevancy, credibility and value, and are actively sharing and interacting with their high society social circles.

Therefore, search engine optimized landing pages, engaging social media posts, blog posts, editorial articles, and social media with the right contents are effective ways for brand awareness and storytelling.

It is critical though to select the right media channels for advertising campaigns. HNWI value their time and want to get useful information in the most efficient manner. They are critical thinkers who prefer to gain credible insights from selected premium information sources.

It’s new: iClick x Forbes Integrated Solution to engage with China’s HNW consumers

Targeting HNWI is a specialized area of digital marketing; reaching the HNWI in China takes local and highly exclusive know-how due to the country’s complex and dynamic digital ecosystem. To bridge marketers worldwide to the Chinese HNWI market, iClick Interactive (NASDAQ:ICLK) (“iClick”) is teaming up with Forbes to offer the iClick x Forbes Integrated Solution to engage and influence China’s HNWI. The solution is a hybrid of online and offline approaches. It combines the advantages of the two titans, from premium exposure on Forbes.com, social and content marketing, to offline private dinners and events executed in China.

iClick is an omni-channel marketing technology company specialized in the China market. Its proprietary precise audience targeting solutions targeting HNWI in China enable clients to leverage unique data sources from Ctrip, Tencent, UnionPay and its own omni-channel platform. The partnerships are set to identify target audiences via real transactions and intent data with exclusive accuracy and insights. The solutions, remarkably, allow the customization of audience segments through multi-dimensional layers based on spending power and behavior, as well as consumer preferences and trends.

iClick x Forbes Integrated Solution gives marketers the best of both worlds, amplifying their messages to the right Chinese HNWI on trusted platforms. Contact iClick to find out more.

Source:

- China increases number of HNWIs in Asia Pacific. (2019, December 4). Retrieved March 12, 2020, from The Asian Banker

- China's ultra rich population seen to rise in next 5 years. (2019, March 6). Retrieved March 12, 2020, from China Daily HK

- The Wealthy In China. (2019). Retrieved March 12, 2020, from Wealth-X

More Insights

Unlock Brand’s Potential in this Year-End Gifting Season!

November 19, 2024

As the year-end holidays draw near, it's prime time to seize the incredible opportunities of this bustling shopping season! The Chinese gift economy is projected to reach RMB 1.4 trillion in 2024, soaring to RMB 1.6 billion by 2027. This is your chance to fully embrace China’s vibrant gifting culture!

iSuite Insights Spotlight – Issue #18 China’s Evolving Perfume Market Landscape 2024

November 19, 2024

The burgeoning perfume market in China is experiencing a remarkable growth in the coming years, especially comparing to the mature markets in other countries. According to an industry white paper, China's perfume market is projected to grow significantly from 22.9 billion yuan in 2023 to 44 billion yuan by 2028, with a CAGR of 14%. Trending perfume topics on Xiaohongshu reflect Chinese consumers’ high demand for high quality products that express individuality and personality.

Baidu Levels Up: Exciting Updates for Marketers!

November 12, 2024

WeChat mini-programs are now directly accessible from Baidu search results, and this means a smoother journey for customers and a significant boost in efficiency and conversion rates for your brand. Just imagine the impact on your marketing strategies!

Supercharge Your Double 11 Sales with Fliggy's Exciting Upgrades!

October 31, 2024

Fliggy is elevating the Double 11 Shopping Festival! Get ready to shine with Fliggy's incredible upgrades, crafted to supercharge your festive marketing efforts.

Unlock E-Commerce Opportunities in Double 11 Shopping Extravaganza

October 29, 2024

Double 11 has become China’s largest online shopping festival. Initially a single-day event on November 11th, it has now evolved into a multi-week shopping extravaganza, starting as early as October.

Elevate Your Hotel's Visibility with the NEW Baidu Map Brand Zone!

October 16, 2024

Attention hotel clients! We’re excited to introduce the new Baidu Map Brand Zone for hotels —a game-changing feature designed to maximize your brand's impact.

Unlock Travel Shifts from 2024 China's National Day Insights

October 8, 2024

As we embark on Golden Week, insights from Trip.com Group’s “2024 National Day Tourism Forecast Report” highlight exciting trends shaping this peak travel season in China. Now is the perfect opportunity to connect with travelers and maximize your marketing efforts!

The Exciting Revival of International Travel and Duty-Free Shopping

October 2, 2024

Exciting news from UN Tourism! International tourist arrivals have surged to 96% of pre-pandemic levels through July 2024, signaling a vibrant comeback for global travel.

Discover New Horizons with WeChat Ads' Enhanced Targeting

September 25, 2024

Exciting Update! WeChat Ads has broadened its targeting options for overseas audiences!