We use cookies to give you the best digital experience. By continuing to browse this site, you give consent for cookies to be used. To learn more information about the use of cookies, please visit our cookie policy.

iSuite Insights Spotlight - Issue #10 Discover The Latest E-commerce Trends And Opportunities

The 618 Shopping Festival, originating from the Chinese e-commerce giant Taobao, has evolved into a massive shopping extravaganza in the Chinese e-commerce market. Today, it includes many other prominent platforms like Alibaba's Tmall, Douyin, and Xiaohongshu, magnifying its reach and impact. According to Iqingyan's statistics, Douyin’s 618 pre-sales of beauty products have reached 3 billion to 3.5 billion yuan, an increase of 60% YoY. The Douyin channel is an important source of growth in the industry and may become the focus for brands.

Based on iAudience and iFans data, we have traced and profiled Chinese netizens who actively followed 618 Shopping Festival-related topics, highlighting their audience profiles and online preferences to understand the targeted Chinese consumers.

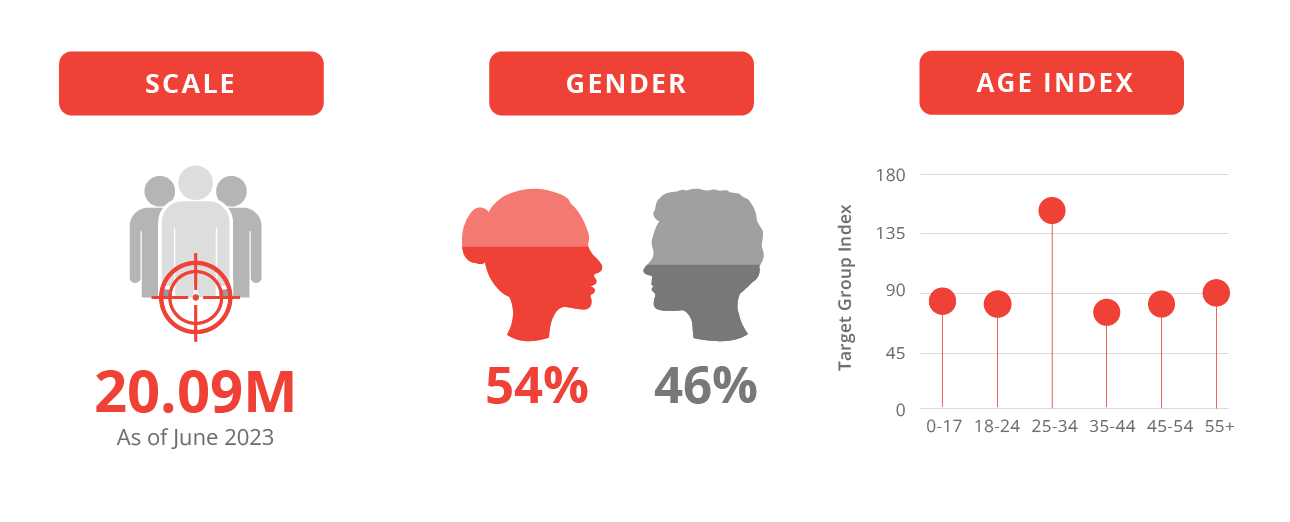

AUDIENCE DEMOGRAPHICS

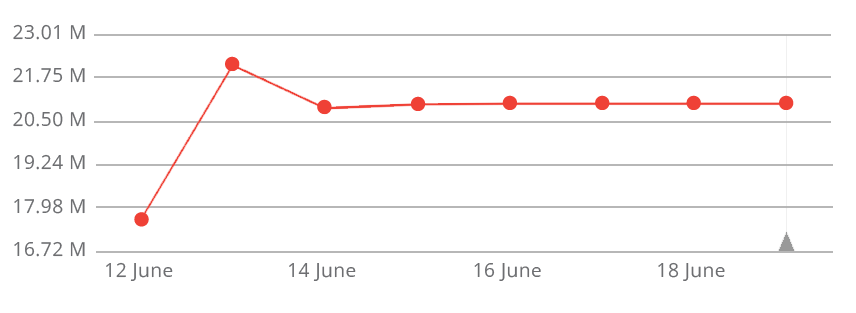

TREND OF AUDIENCE SCALE

- Five days prior to the 618 shopping festival, the number of audience reached its highest level and remained high.

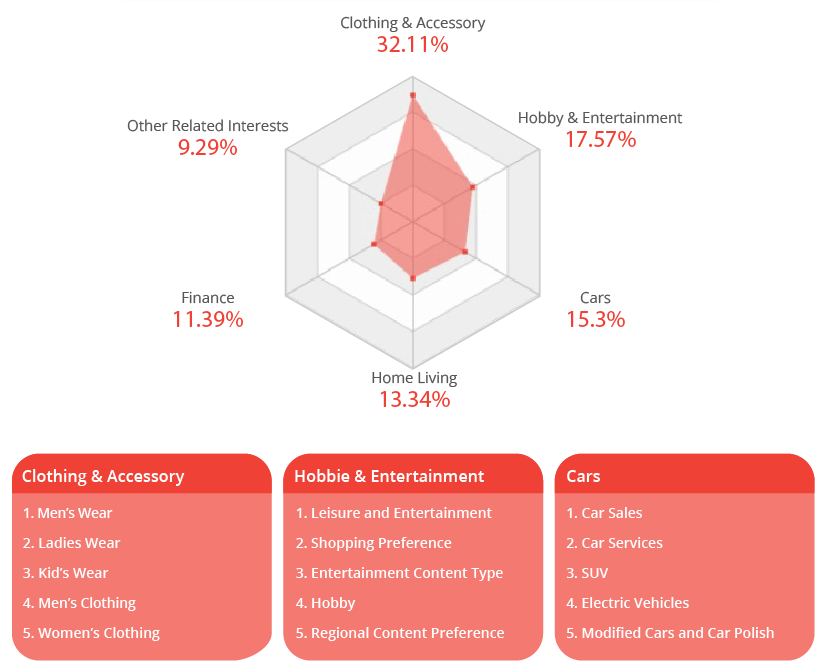

AUDIENCE INTERESTED CATEGORIES

- Audience-interested categories are Clothing & Accessories, Hobby & Entertainment, and Cars.

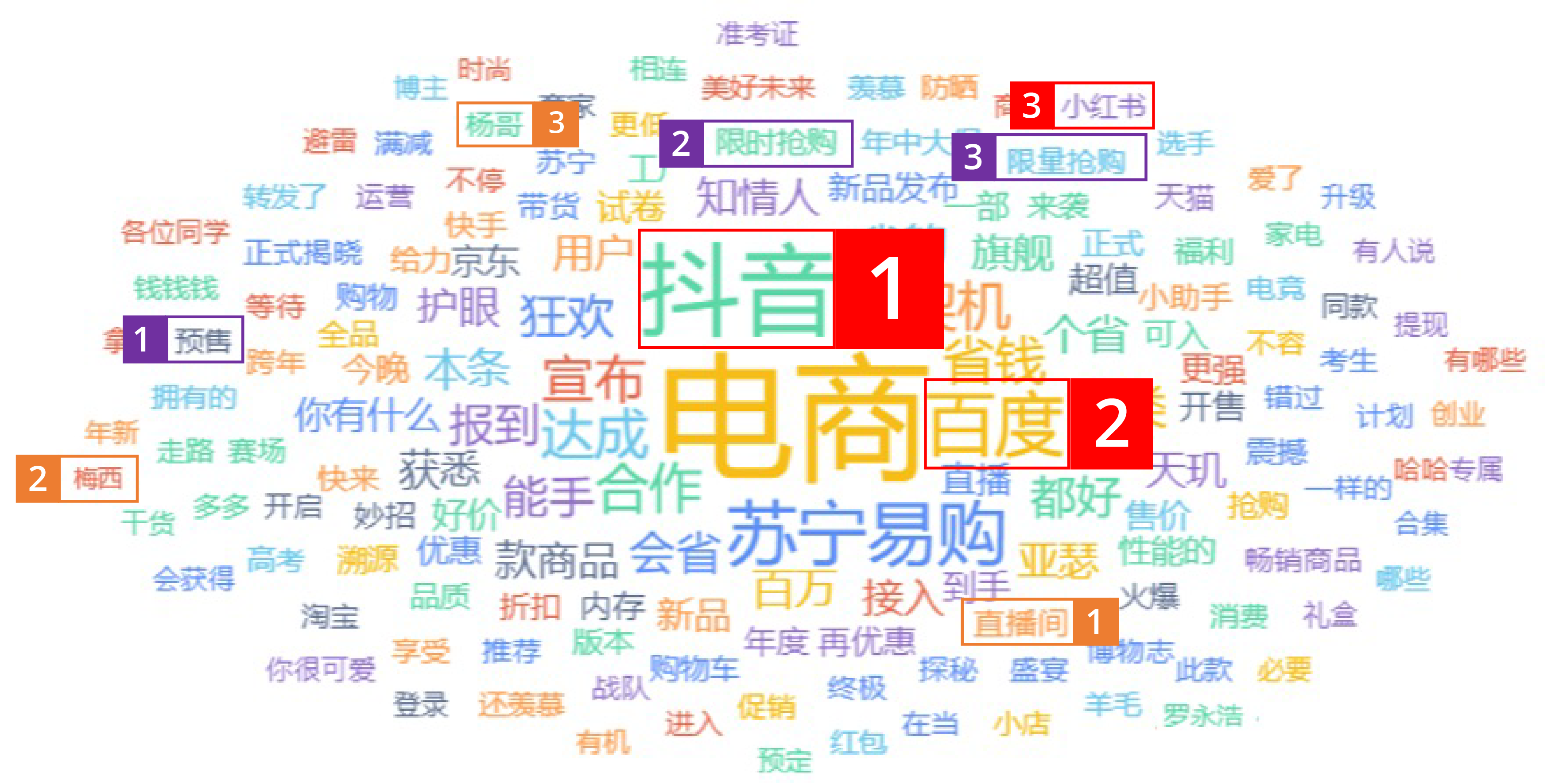

PUBLIC OPINION KEYWORDS

E-commerce Platforms: Douyin1, Baidu2, Xiaohongshu3

Livestreaming: Livestreaming Ecommerce1, Messi2, Yangge3

Promotions: Pre-sales1, Limited Time Offer2, Limited Offer3

- KOL-hosted Livestreaming is one of the highlighted promotions during the 618 Shopping Festival.

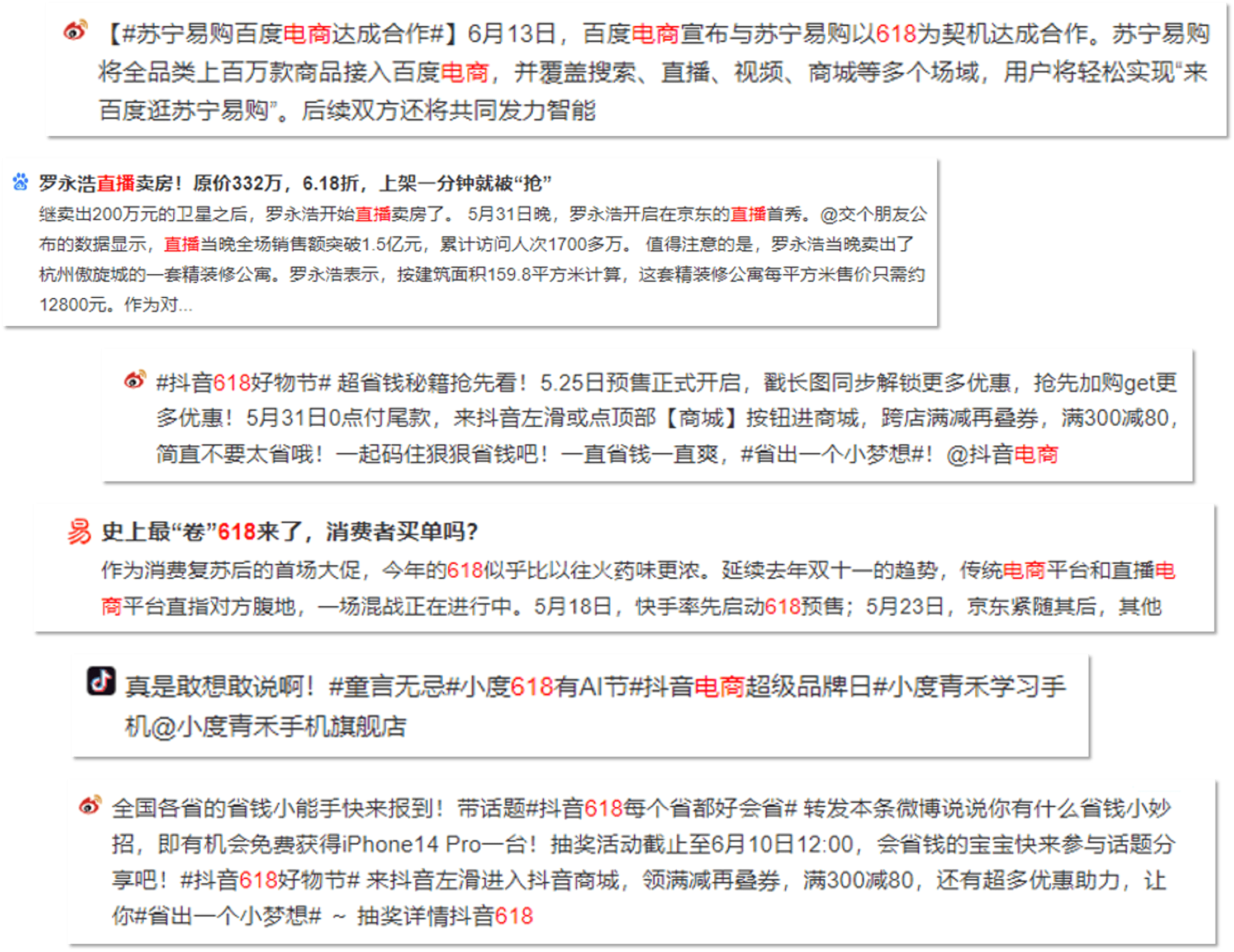

HOT SEARCHES ON WEIBO

- Hot searches on Weibo are mainly related to the 618 Shopping Festival.

TOP 5 SHORT VIDEO PLATFORMS

- Livestreaming and Short Video Platforms are increasingly significant in the Chinese 618 Shopping Festival.

PUBLIC OPINION SNAPSHOTS

- In a fiercely Competitive Market, attracting and maintaining traffic is more challenging for brands.

More Insights

Elevate Your Hotel's Visibility with the NEW Baidu Map Brand Zone!

October 16, 2024

Attention hotel clients! We’re excited to introduce the new Baidu Map Brand Zone for hotels —a game-changing feature designed to maximize your brand's impact.

Unlock Travel Shifts from 2024 China's National Day Insights

October 8, 2024

As we embark on Golden Week, insights from Trip.com Group’s “2024 National Day Tourism Forecast Report” highlight exciting trends shaping this peak travel season in China. Now is the perfect opportunity to connect with travelers and maximize your marketing efforts!

The Exciting Revival of International Travel and Duty-Free Shopping

October 2, 2024

Exciting news from UN Tourism! International tourist arrivals have surged to 96% of pre-pandemic levels through July 2024, signaling a vibrant comeback for global travel.

Discover New Horizons with WeChat Ads' Enhanced Targeting

September 25, 2024

Exciting Update! WeChat Ads has broadened its targeting options for overseas audiences!

Reach Millions of Eager Travelers with Qunar this National Day!

August 26, 2024

As China's outbound tourism surges back to life, Qunar is launching an exclusive new travel campaign tailored specifically for the 2024 National Day holiday period.

Xiaohongshu's Ecommerce Elevation: Merchant-First Campaign and Platform Innovations

August 20, 2024

Calling all brands with ecommerce business! Xiaohongshu (XHS) has launched a new merchant-first campaign to supercharge your growth.

Unlock the Power of China's Affluent Professional Network with MaiMai

July 31, 2024

MaiMai is China's premier professional social platform, boasting a thriving community of over 1.2 billion users - all young, educated, and influential. With 70% of this user base residing in the country's top-tier cities, MaiMai connects you to the next generation of China's business leaders and high-spending consumers.

China's Booming Mini-Program Ecosystems

July 12, 2024

Did you know that the largest mini-program ecosystem in China is actually within WeChat, the country's ubiquitous super app? But Alipay, the digital wallet app, has emerged as the #2 player - and it's growing fast!

Xiaohongshu's First Platform-Level IP for New Product Success

July 8, 2024

Xiaohongshu (XHS) launched its first platform-level product marketing IP 「宝藏新品」("Treasure Trove") in May 2023, taking a holistic approach to supporting brands in successfully launching and growing new products on the platform